The Ohio Citizens PAC

Ohio Citizens PAC, P.O. Box 6211, Akron, OH 44312

Contact Us: Info@OhioCitizensPAC.org

Click Here to Donate to the Ohio Citizens PAC

IT IS TIME FOR PATRIOTS TO ACT!

SIGN THE PETITION TO REPEAL ALL PROPERTY TAXES IN OHIO AND VOLUNTEER TO COLLECT SIGNATURES!

After suffering 30% increases in Property Tax Bills in some parts of the State, angry Property Owners are no longer willing to wait for the Legislature to take action! They are in the process of gathering 550,000 signature to but the language below on the Ballot so Ohioans can vote to abolish taxes on real property! If you are in favor of this Amendment and want to sign the petition and/or work to collect signatures. Click here for all the pertinent information!

SHOULD THE OHIO REPUBLICAN PARTY ENDORSE VIVEK RAMASWAMY & JON HUSTED?

Something very interesting is happening TODAY (5-9-25) in Columbus. The Ohio Republican Party State Central Committee is having a meeting at which they are expected to vote on whether or not to endorse Vivek Ramaswamy for Ohio Governor AND Jon Husted for US Senate. What makes this unusual is the fact that the 2026 Republican Primary Election is a YEAR AWAY! Endorsing this early is unprecedented. Though the Ohio Republican Party did actually endorse President Trump on December 1, 2023 nearly a YEAR before the 2024 General Election!

President Trump has personally endorsed BOTH Ramaswamy and Husted and Donald Trump Jr. just put out a statement on X asking for the ORP Central Committee to support the President and Endorse. Ohio Governor Mike DeWine and the Republican Party Establishment desperately want to prevent Ramaswamy from being endorsed on Friday. They do not want a candidate they can't control.

For those us in the Ohio Grassroots Movement, this vote puts us in a difficult position. On one hand, we are fundamentally opposed to endorsing in any primary. We believe that the voters should pick who they want as the candidate for their party. While that is a noble idea, the fact is that in Ohio EVERY State primary has been rigged by the Republican Party to favor their "insider" who will continue the ORP's control over Ohio's Government - and our tax dollars.

Worse yet, because Ohio has "Open Primaries" where Democrats and everyone else can vote in the Republican Primary, Democrats are often encouraged to cross over and vote for the most Democrat-like candidate in the Republican Primary! As I explain in the video below, next May the plan of the Columbus Cartel is to run former OSU Football Coach Jim Tressel for Governor to attract hundreds of thousands of Democrat football fans to cross-over and vote in the Republican Primary. If elected Tressel would be 74 years old with little political experience to start his first term as Governor. He would be surrounded by members of the Establishment so that they could continue to be in charge of Columbus.

On the other hand, we are loyal to President Trump, whose actions made it possible for the first time for We the People to have an "outsider" like Vivek Ramaswamy to run for Ohio Governor. (Again, watch the short video.) We have worked for a long time to elect someone as Governor who will put the citizens of Ohio First and not be owned by the Donors and Special Interests or beholding to the political machine in Columbus. We want to DOGE Ohio and that is something the Cartel can never allow! Ramaswamy, like Trump, can self-fund his campaign and therefore cannot be bought - which is why they fear him. Friday is an opportunity for the Grassroots to advance our cause by voting to endorse. The fact is we may never get that chance again. Which is why the Columbus Cartel is desperately trying to defeat Vivek Ramaswamy and President Trump's agenda today.

In the short video below, I share my advice with the State Central Committee Members. Click the image or the link below to watch it and see if you agree with my logic.

Then click the image below that to actually WATCH the LIVE Meeting this Morning to see if YOUR State Central Committee Member votes the way that you think they should!

For Liberty,

Tom Zawistowski

President

We the People Convention

Click Here to Watcth Tom Z's Message Video!

Click Here To watch the ORP Meeting Starting at 10:00 AM!

PRESS RELEASE

For Immediate Release: Wednesday, March 20, 2024

Contact: Tom Zawistowski, TomZ@WethePeopleConvention.org

HUGE WIN FOR MAGA IN OHIO

Akron, OH: Today, Tom Zawistowski, President of the TEA Party-affiliated national We the People Convention (WTPC) organization, congratulated Ohio Trump supporters who came out and voted to elect Bernie Moreno as the Republican nominee for US Senate with 50% of the primary vote, vs 33% for Matt Dolan and 17% for Frank LaRose. Zawistowski also celebrated conservative wins in Congressional, State and local races.

Zawistowski said to the conservative voters, "You turned out and you defended President Trump and the Make America Great Again (MAGA) America First Agenda! By overwhelmingly electing Bernie Moreno as our US Senate Republican nominee, you put Sherrod Brown and his Marxist allies on notice that we will be united in November in a way that they have never seen before in Ohio. This nonsense that was being spread that Democrats were going to crossover and vote for Moreno because he was the weakest of the Republican Candidates is dead wrong. With Donald Trump and Bernie Moreno on the ticket the Democrats in Ohio are going to be in a world of hurt, not just in the Presidential and Senate races, but all the way down the ticket down to dog catcher! The Ohio Democrat/Socialist Party is now officially on the Endangered Species list in Ohio.

Zawistowski continued, "Second of all, you defeated the Ohio RINO Establishment and finally made it clear that Ohio and the Ohio Republican Party belongs to We the People! Bernie Moreno said it exactly right in this quote to Axios before the election, "It is a race between the America-first Republican Party and the broken-down RINO Establishment." In this Primary you defeated RINO's Portman and DeWine and Kasich and the party elites who have been grifting off our hard work and votes since the TEA Party started in Ohio in 2009. Moreno and Vance and Jim Jordan and Warren Davidson and Vivek Ramaswamy and others do not belong to that "country club". They have heard from the MAGA voters and they know that our Freedom, Liberty and Prosperity are in real danger because the RINO's have sold-out Ohio and our nation for their own personal gain for decades. This was further demonstrated by significant wins in Ohio House races against Democrat funded "Blue 22 Republicans" in a rejection of the RINO's pay-to-play culture in Columbus. It is past time to put Americans and America First Again and that is what tonight was all about."

Zawistowski closed by saying, "We want to thank Secretary of State Frank LaRose and his team, and all the tens of thousands of election workers who work such long hours, for running a very smooth election with only one incident in the state that was quickly addressed and did not have any effect on votes or voters. The 20% turnout, 1.6 million of 8 million registered voters, was about average for recent primary elections. Nearly 1.1 million citizens voted in the Republican primary while just over 500,000 voted in the Democrat Primary."

List of Candidates Endorse by the Ohio Citizens PAC for the March 19, 2024 Republican Primary:

The Ohio Citizens PAC hereby ENDORSES ALL 17 of the Patriots in the List Below to be YOUR New Representative in the Ohio House next year!

We ask all Ohio Patriots to look at this list to see if you have someone running in your House District. If so, we ask that you seek out our WTPC Endorsed candidate to donate to their campaign and volunteer to help get them elected. We also ask that you share this email with everyone you know in the state so that they can see that We the People are taking action to replace those who so callously stole our votes and gave them to the Democrats last year! On March 19th of this year - ALL 17 of our candidates must win the Primary and avenge our stolen votes! That only happens if YOU donate to them, you work for their campaign, you ask others to vote for them, and YOU VOTE FOR THEM!

SUPPORT THOSE CANDIDATES RUNNING TO DEFEAT THE BLUE 22 and the Others we list below!

Heidi Workman - Ohio 72nd House District

Website Link: www.heidiworkman.com

Donation Link: https://secure.winred.com/workman-for-the-people/donate-today

Facebook Link: facebook.com/WorkmanforOH

Twitter Link: twitter.com/WorkmanforOhio

Instagram Link: instagram.com/WorkmanforOhio

Jodi Salvo - Ohio 51st House District

Website Link: https://jodisalvoforstaterep.com/

Donation Link: https://secure.winred.com/friends-of-jodi-salvo/donate

Facebook Link: https://www.facebook.com/salvoforohio

Checks can be mailed to: Friends of Jodi Salvo, P.O. Boc 636, Zoar, OH 44697

George Brunemann - Ohio 29th House District

Website Link: https://FriendsOfLiberty.US

Donation Link: https://friendsofliberty.us/make-a-donation

Email: george@FriendsOfLiberty.US

Mike Tussey - Ohio 73rd House District

Website Link: www.TusseyForStateRepresentative.com

Checks can be Mailed to: Citizens for Tussey, P.O. Box 1, Baltimore, Ohio 43105

Nelson Roe - Ohio 95th House District

Facebook Link: www.facebook.com/FriendsofNelsonRoe

Donation Link: Https://secure.winred.com/friends-of-nelson-roe/donate-today

Checks can be Mails to: Friends of Nelson Roe, 50958 Wargo Rd, Cumberland, Ohio 43732

Steve Kraus - Ohio 89th House District

Donate Link: https://secure.anedot.com/friends-of-kraus/donate

Dillon Blevins - Ohio 62nd House District

Link to donate: https://secure.winred.com/committee-to-elect-dillon-blevins/donate

Website: blevinsgop.com

Facebook: https://www.facebook.com/blevinsforstaterep

David Thomas - Ohio 65th House District

Website Link: www.davidthomasforohio.com

Donation link is: https://secure.winred.com/friends-of-david-thomas/donate

Facebook Link is: www.facebook.com/friendsofdavidthomas

Sally Culling - Ohio 75th House District

Website: www.SallyforOhio.com

Donation Link: https://secure.anedot.com/sally-culling-for-ohio/donate

Heather Slayer - Ohio 56th House District

Website: www.heathersalyer.com

Facebook: https://www.facebook.com/VoteHeather

Jack Daniels - Ohio 32th House District

Checks can be Mails to: 3397 E. Waterloo Road, Akron, Ohio 44312

Ty Mathews - Ohio 83th House District

Donation link is: https://www.mathewsforohio.com/donate

Facebook Link is: https://www.facebook.com/tymathewsforohio

Wezlynn Davis - Ohio 86th House District

Link to donate: https://secure.winred.com/friends-of-wezlynn-davis-7f7c00e2/davisdonate

Facebook: https://www.facebook.com/wezlynndavisforstaterep

Checks can be Mails to: Friends of Wezlynn Davis, PO BOX 188, Marysville, OH 43040

Patty Hamilton - Ohio 12th House District

Website: https://www.patty4OhioRep.com

Link to donate: https://politics.raisethemoney.com/en/phamilton

Checks can be mailed to: Hamilton for State Rep, 22798 Morris Leist Rd., Stoutsville, OH 43154

Beth Lear - Ohio 61st District

Website Link: https://bethlear.com

Link to Donate: https://bethlear.com/donate/

Checks can be mailed to: Lear for Liberty, 7490 Big Walnut Road, Galena , OH 43021

Mischelle Teska - Ohio 55th House District

Website: https://www.teska2024.com

Donate Link: https://www.teska2024.com/donate

Anthony Savage - Ohio 54th House District

Website: http://savageforohio.com

George Young - Ohio 4th Senate District

Website: http://www.electgeorgelang.com

Donate Link: https://secure.anedot.com/friends-of-george-lang/donate

If a candidate for Ohio House would like to be endorsed by the Ohio Citizen PAC write to:

TomZ@OhioCitizensPAC.org for Consideration

How Conservative are their Votes?

Would you Agree with their Votes?

Click HERE to FIND OUT - BEFORE YOU VOTE on March 19th

Portage County Blue 22 Traitor Gail Pavligia, literally told a group of supporters this weekend that the reason she voted no on Senate Bill 83 in committee last week was because "it takes away tenure for University professors." Adding that "good" professors will not come to Ohio if they have a choice to teach at a university in a state that allows tenure. Really "Professor" Pavligia? Here is a News Flash from every American with a Brain - TENURE DOES NOT PROTECT GOOD PROFESSORS IT PROTECTS HORRIBLE ANTI-AMERICAN MARXIST PROFESSORS!

Remember this guy? This is Kent State University Tenured Professor Julio Pino who had been involved in a long series of anti-Semitic controversies relating to American foreign policy, Islam, suicide bombing, jihad, and Israel. These include a 2012 newspaper column praising the actions of the terrorist who carried out the Kiryat Yovel supermarket bombing. Thanks to Ohio "Republican" Betrayal of conservative voters for decades, this Terrorist was paid with your tax dollars to "teach" Ohio's Children in the classroom that America is the Great Satan. He referred to YOUR CHILDREN in his classroom affectionately as his "little Jihadists" and his "beloved Taliban." Because of Tenure, Kent State did not, or could not, fire him until he was convicted of lying to the FBI in 2018.

This is who Pavligia and the Blue 22 are Representing! NOT YOU! Tenure was originally intended to protect researchers and important thinkers from outside societal and government pressures so that they could think objectively and honestly about major issues of the day. Like everything else that the radical left touches, from the 1960's forward the Marxist used Tenure as shield for their Anti-American, Anti-Western Civilization activities hiding behind bogus claims of academic freedom to instead plot, and now implement, the literal overthrow of the United States Government and destruction of American and Western society. The left used Tenure to drive out America loving, Constitution loving, teachers and administrators from K-12 to College in order to indoctrinate our children as the Communist Manifesto Instructed. As was on full display last week in the horrific testimony of the Woke, Joke, Ivy League Presidents! ALL with the full support of "Republicans" like Pavligia and her Blue 22 Comrades. AND THEY ARE TRYING TO DOING IT AGAIN THIS WEEK by NOT Allowing Senate Bill 83 to come to the floor of the Ohio House!

Republicans? REPUBLICANS!!! These Blue 22 people AREN'T EVEN AMERICANS! Pavligia and the rest are Communist Sympathizers if not actual Communist themselves! Why else would you be trying to Stop Ohio from getting rid of Tenure so that we can clean out our Colleges???? Why else would they be wanting to fund and protect the Marxists who want to attack our children with the Anti-American Critical Race Theory, and the Racist DEI Ideology and the sick and destructive "Trans Agenda"??? Pavligia said it herself this weekend! These people not only DON'T REPRESENT YOU they HATE YOU! They are PERSONALLY RESPONSIBLE for hurting our children and destroying our State and Nation! So what are YOU going to do about it???

If you really love our children and our beloved Ohio and America, now, TODAY, is the time you must stand up and protect them. Every one of you MUST stop what you are doing and contact these Blue 22 Traitors by phone, by email or in person and make it clear to them that you want Senate Bill 83 brought to the floor and voted out of the House this week for Governor DeWine's signature. This is not negotiable. They either Represent the Will of the People or they must be removed from Office in the March 19, 2024 Primary Election. If they have a person running against them in the Primary, contact that person, volunteer to help their campaign, donate to them, then vote them in. If they do not yet have a challenger in the Primary, then put YOUR NAME on the Ballot before the December 20th Deadline, it only takes 50 signatures and $85 to run against them. Then run against them on just this one issue! It is each of our personal responsibilities to hold these people accountable and they way we do that is by voting them out of office!

I implore you - ACT TODAY!

For Liberty,

Tom Zawistowski

Executive Director, Portage County TEA Party

President, We the People Convention

Click Here to Donate to the Ohio Citizens PAC

Ohio Citizens PAC Endorsed Candidates for the Ohio AUGUST 2, 2022 Republican Primary:

PLEASE NOTE: Most other political action committees are SINGLE ISSUE PAC's. That makes sense. If you are a Gun group or a Pro-Life Group or a Pro-Business group, you would endorse candidates based on how they vote or would vote on YOUR SINGLE ISSUE. However, the Ohio Citizens PAC represents a wider conservative base of Patriots who care about ALL those issues. Therefore candidates are held to what might be called a higher standard by the Ohio Citizens PAC. They have to be "right" on a lot of issues, not just one or two. Below is our list of Endorsed Candidates who we believe meet that "Higher Standard". We ask you to print this page, or take it with you to the voting booth on your phone, and vote for the Candidates that we Endorse here, because our research indicates that they are the best candidates to represent YOUR VALUES if they are elected to Office!

For Liberty,

Tom Zawistowski

Treasurer

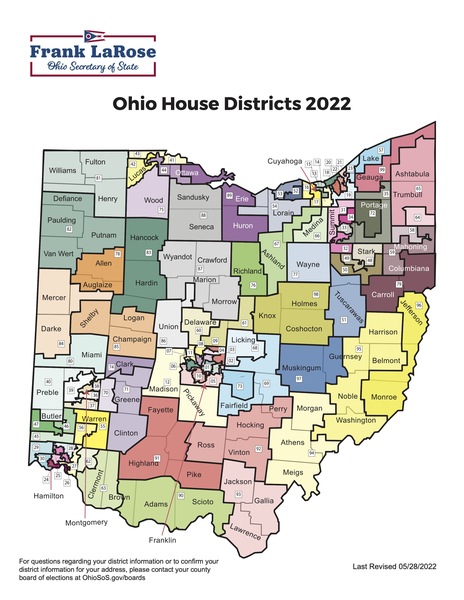

Since they changed all the Districts for this election . .

Please Click Here to find out which Senate or House District you are in!

Then see below if we have an endorsement in your District!

READ: August 2nd Ohio Primary was a Debacle!

Ohio State Senate Endorsed Candidates:

* = Incumbent

Winners: 3/4

District 13: Kirsten Hill

District 19: Andrew Brenner *

District 21: Mikhail Alterman

District 27: Kristina Roegner *

Please Click Here to find out which Senate or House District you are in!

Ohio State House of Representatives Endorsed Candidates:

*=Incumbent

Winners: 20/33

District 3: Josiah Lanning *

District 14: David Morgan

District 17: Ryan McClain

District 27: Jenn Giroux

District 28: Kim Georgeton

District 30: Angela Hymer

District 33: Kristopher Anderson

District 35: Steve Demetriou

District 40: Rodney Creech *

District 45: Jennifer Gross *

District 46: Thomas Hall *

District 47: Cory Harper

District 50: Reggie Stoltzfus *

District 54: Kathleen Beyer

District 55: Thomas Goodwin

District 61: Beth Lear

District 65: Mike Loychik *

District 67: Melanie Miller

District 68: Thaddeus Claggett

District 70: Katherine Shutte

District 71: Bill Dean*

District 72: Gail Pavliga *

District 77: Scott Wiggam *

District 78: Joseph Sreenan

District 80: Jena Powell *

District 84: Angie King

District 85: Lilli Vitale

District 86: Michael Bohland

District 88: Gary Click *

District 90: Calvin Robinson

District 94: Jay Edwards*

District 98: Scott Pullins

District 99: Sarah Fowler *

Ohio Republican Party State Central Committee Endorsed Candidates:

(by Ohio Senate District)Winners: 33/66

District #1: James Horton and Gina Campbell

District #2: Joshura Culling and Lisa Crescimano

District #3: Jim Burgess Sr and Mata Hahn

District #4: Kent Keller and Marilyn Tunnant

District #5: Steve Bruns and Jessica Franz

District #6: Arthur McGuire and Judy Westbrook

District #7: Seth Morgan and Lori Viars

District #8: George Brunemann and Barbara Holwadel

District #9: Tom Chandler and Linda Matthews

District #10: Mark Johnson and Larua Rosenberger

District #11: Tim Brentlinger and Abigail Brentlinger

District #12: Jacob Eilerman and Stepahie Kremer

District #13: Mike Witte and Jean Anderson

District #14: Christopher Orleck and Gloria Martin

District #15: Joe Healy and Penny Martin

District #16: Geoff Hatcher and Michelle Anderson

District #17: Scott Greene and Angela Ryan

District #18: Jack Boyle and Denise Verdi

District #19: Gary James and Melanie Leneghan

District #20: Jake Warner and Sabrina Warner

District #21: Joe Miller and Laverne Gore

District #22: Dakota Thomas (Sawyer) and JoAnn Campbell

District #23: Jonah Pelton and Doris Peters

District #24: Shannon Burns and Melanie Mason

District #25: Jim Burgess III and Stacy Bayliff

District #26: Jonathan Zucker and Lisa Cooper

District #27: Bryan Williams and Stephanie Stock

District #28: NOT JIM SIMON - Mike Berger and Patty Gascoyne

District #29: Curt Braden and Christine Maurer

District #30: Shannon Walker and Nicole Hunter

District #31: Charles Blake and Antonia Blake

District #32: Charles Johnson and Kathi Creed

District #33: Rick Barron and Monica Robb Blasdel

About the Ohio Citizens PAC

The purpose of the Ohio Citizens PAC is to advocate for conservative issues and candidates that advance the cause of Individual Freedom and Liberty in the form of Constitutionally limited government.

The Ohio Citizens PAC is a State of Ohio Registered Political Action Committee based in Akron, Ohio that was founded in 2011.

Our Mailing Address is: Ohio Citizens PAC P.O. Box 6211 Akron, OH 44312

DONATE HERE